- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Illinois Tool Works' Quarterly Earnings Preview: What You Need to Know

/Illinois%20Tool%20Works%2C%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $76.1 billion, Illinois Tool Works Inc. (ITW) is a global manufacturer of a diversified range of industrial products and equipment. Operating through seven business segments, ITW serves a wide array of markets, including automotive, food equipment, electronics, welding, construction, and specialty products. ITW is expected to release its fiscal Q2 2025 earnings results on Tuesday, Jul. 29.

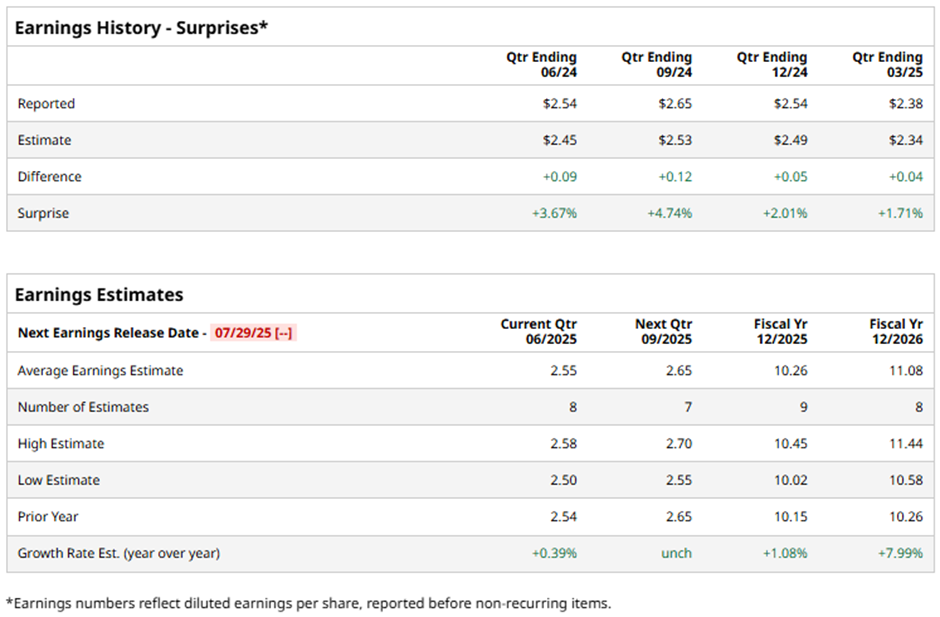

Ahead of this event, analysts project the Glenview, Illinois-based company to report an EPS of $2.55, a marginal growth from $2.54 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in the last four quarters. In Q1 2025, Illinois Tool Works surpassed the consensus EPS estimate by 1.7%.

For fiscal 2025, analysts forecast the equipment manufacturer to report EPS of $10.26, up 1.1% from $10.15 in fiscal 2024. Moreover, EPS is expected to grow nearly 8% year-over-year to $11.08 in fiscal 2026.

Over the past 52 weeks, shares of Illinois Tool Works have gained nearly 11%, underperforming the broader S&P 500 Index's ($SPX) 12.3% return and the Industrial Select Sector SPDR Fund's (XLI) 24.1% increase over the same period.

Illinois Tool Works reported better-than-expected Q1 2025 net income of $2.38 per share, beating the consensus estimate, with revenue of $3.8 billion matching Street forecasts. Despite the earnings beat, shares fell marginally on Apr. 30 as investors reacted to a 3.4% year-over-year sales decline, a drop in operating margin to 24.8%, and ongoing concerns about tariffs and weak demand in some markets. The management acknowledged the "uncertain external environment" but reaffirmed full-year guidance, citing price increases and strategic actions to offset tariff impacts.

Analysts' consensus view on Illinois Tool Works stock is cautious, with a "Hold" rating overall. Among 17 analysts covering the stock, three suggest a "Strong Buy," 10 give a "Hold," one has a "Moderate Sell," and three provide a "Strong Sell" rating. As of writing, the stock is trading above the average analyst price target of $251.80.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.