- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Dividend Danger: Wall Street’s Betting That the Ford Stock Dividend Isn’t Long for This World

/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

The most critical component of a dividend payout is profitability. As long as the company has adequate profits, which are preferably growing, dividend payouts are a useful tool to reward shareholders for their investments into the company. But what happens when the profits are declining? That is exactly what is happening with automobile major Ford (F).

About Ford

Founded in 1903 by the legendary Henry Ford, Ford is a leading global automaker producing passenger vehicles, SUVs, trucks, electric vehicles (under its Model e initiative), commercial vans and services (through Ford Pro), and financing solutions (via Ford Credit). Ford revolutionized manufacturing with the moving assembly line and has remained in family control for over a century.

Valued at a market cap of $46.7 billion, F stock is up 19.4% on a year-to-date (YTD) basis, while offering a dividend yield of 6.35%.

However, the company's market cap has more than halved from its all-time high levels of around $100 billion in January 2022, while it is also down from its $55 billion market cap in August 2015. But can it stage a turnaround? I think it can, and here's why.

Ford's Strategic Investments & Sales Momentum Bode Well Amid Tariff Clouds

Ford’s showing in the fast-growing and highly competitive electric vehicle (EV) market has been underwhelming, with its EV division projected to record a $5 billion loss this year. Flagship electric offerings like the Mustang Mach-E and the F-150 Lightning, once seen as central to Ford’s transition away from gasoline models, have experienced slower sales than anticipated.

Yet, to turn things around and cut losses, Ford is rolling out several strategic measures. A major step includes nearly $2 billion in upgrades to the Louisville Assembly Plant to build a new mid-size electric pickup. This project is part of a broader $5 billion push to improve efficiency and strengthen competitiveness. The plan involves setting up a battery manufacturing facility to lower production costs and refining manufacturing processes to drive down expenses.

Meanwhile, numbers for the latest quarter have also brought some positive signs. In Q2 2025, Ford outperformed the broader auto sector, driven by robust demand for key models. F-Series deliveries reached 222,459 units, and the Maverick hit a record 48,041 units. SUV performance was also strong, with the Navigator jumping 115% and the Expedition climbing 43.9% to over 31,000 units. Additionally, the Bronco posted its highest quarterly sales since its 2021 launch, exceeding 39,000 units.

Further, the electrified vehicle segment reached an all-time quarterly high, supported by a 23.5% rise in hybrid sales. Also, Ford Pro, the company’s commercial arm, is gaining momentum by offering a full suite of vehicles, software, charging infrastructure, and maintenance services to business clients. Its Ford Pro Telematics platform, designed to give fleet operators actionable operational data, now has 750,000 active software subscriptions.

However, tariffs remain a major headwind. Ford expects total tariff expenses to surpass $2 billion in 2025, with the possibility of extra duties on imports from Canada and Mexico adding further strain. Consequently, the company lowered its 2025 adjusted EBIT forecast to $6.5-7.5 billion, trimming $0.5 billion from the low end and $1 billion from the high end of its earlier outlook.

Unglamorous Financials With a Solid Base and Alarmingly High Debt Levels

Unlike its cars, Ford's financials do not grab much attention at first glance. Over the past 10 years, the company's revenue and earnings have reported CAGRs of just 2.70% and 3.53%, respectively.

Moreover, over the past nine quarters, Ford's earnings have reported year-over-year (YoY) declines on five occasions. However, in the same period, its earnings have missed Street expectations in just two instances.

Further, in the latest quarter, the company reported a beat on both the revenue and earnings front. In Q2 2025, Ford's revenue stood at $50.2 billion, which denoted a growth of 5% from the previous year. Meanwhile, although EPS declined to $0.37 from $0.47 in the year-ago period, it was higher than the consensus estimate of $0.33. Declining operating profit margins (4.3% in Q2 2025 vs 5.8% in Q2 2024) remain a concern, though.

Net cash flow from operating activities jumped to $2.01 billion for the first half of 2025, compared to $1.01 billion in the corresponding period a year ago. Overall, Ford closed the quarter with a cash balance of $8.57 billion, which was substantially lower than its short-term debt levels of $54.9 billion, raising solvency issues for the company.

Overall, the stock continues to trade at reasonable levels, despite the uptick this year. Its forward price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) of 10.23, 0.27, and 7.49 are all lower than the sector medians of 20.15, 0.97, and 11.46, respectively.

Analyst Opinion on F Stock

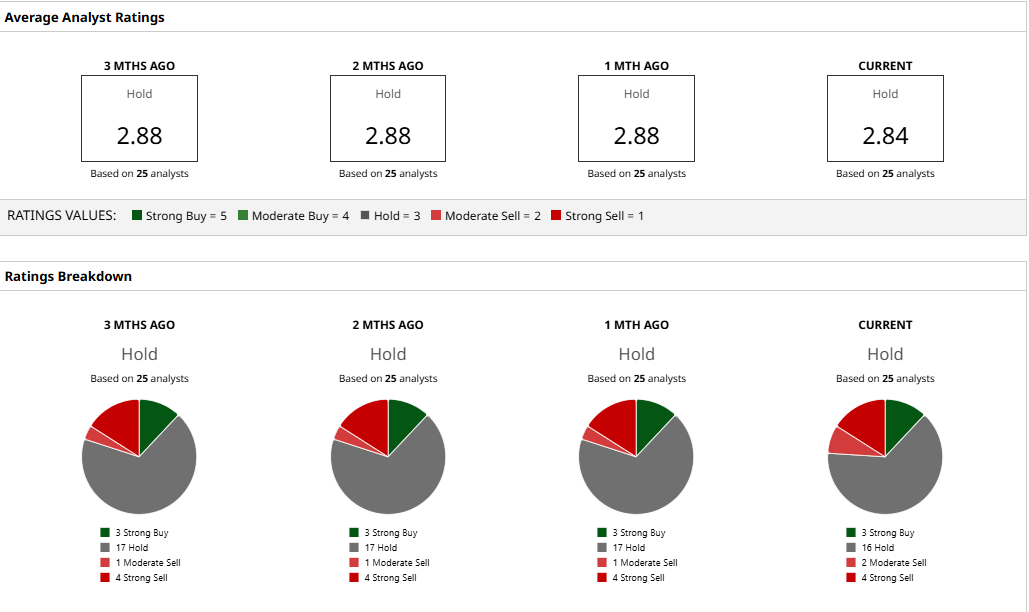

Thus, amid mixed signals, analysts have a consensus “Hold” rating for the F stock, with a mean target price of $10.41, which has already been surpassed. The high target price of $14 indicates an upside potential of about 18.4% from current levels. Out of 25 analysts covering the stock, three give it a “Strong Buy,” 16 have a “Hold,” two have a “Moderate Sell,” and four have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.