- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Top 3 Dividend Aristocrats With Safe Payouts and Upside Potential

Those who’ve read my previous articles know how much I like dividend stocks, as I am a particular kind of investor. Many ask me for advice on which dividend companies to invest in, the factors to consider, the ideal dividend yield, and other questions about selecting a dividend company.

Frankly, there are no “right companies” to invest in, as the decision largely depends on the investor’s goal or desired outcome. Personally, I prefer to invest in dividend companies that I can “buy and forget,” which means companies with a high likelihood to provide stable income and long-term capital appreciation without needing to check my portfolio every two hours.

If that sounds like the kind of investment you’d also prefer, then I’ll show you my top 3 dividend companies you can buy and hold for as long as necessary.

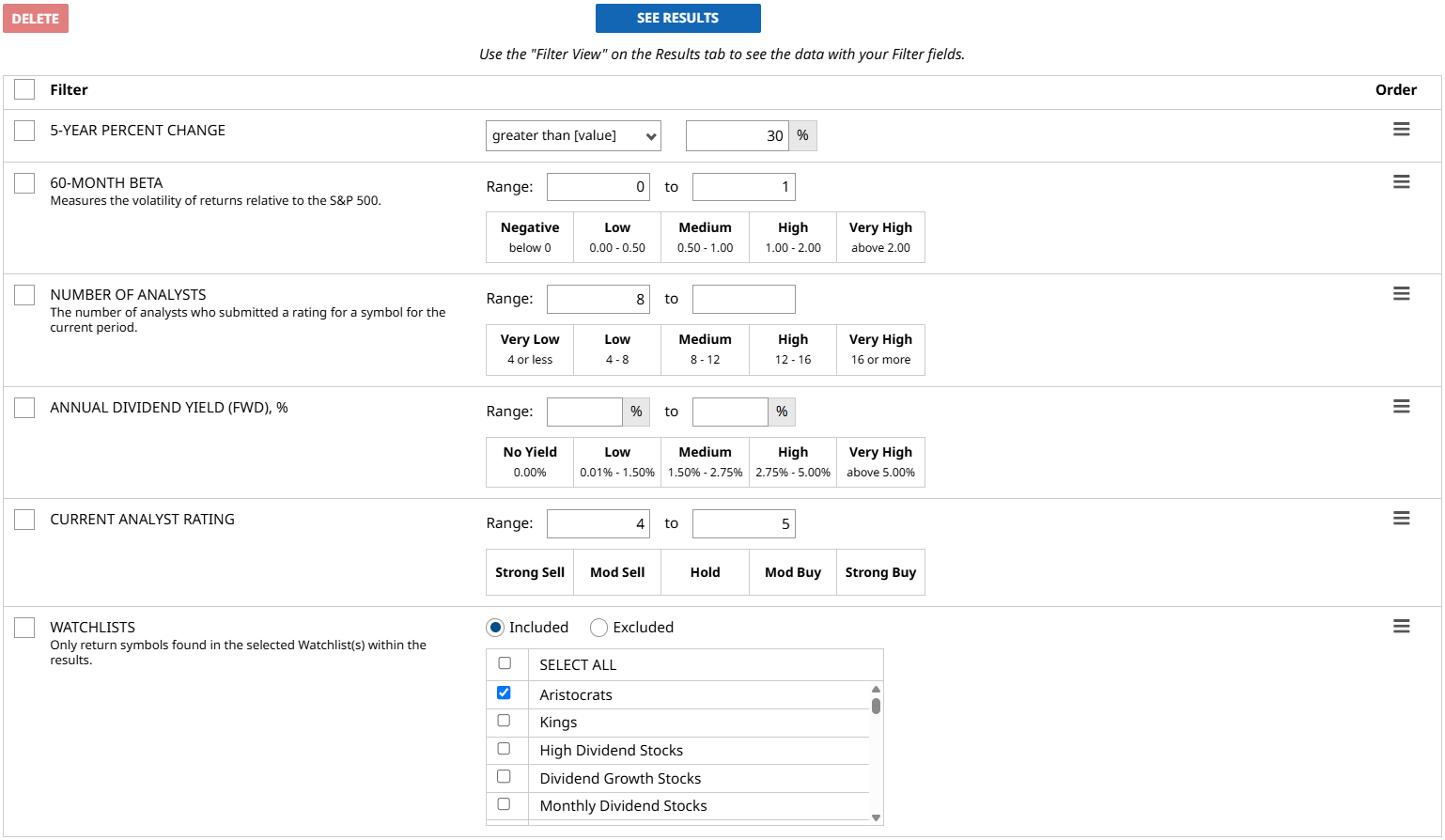

How I Came Up With The Following Dividend Stocks

- Watchlist: Dividend Aristocrats. To only see companies that are members of the S&P500 index and have increased dividend payout for at least 25 years.

- 60-Month Beta: 0 to 1. This metric shows how stable the stock is relative to the broader market. A stock with a score between 0 and 1 is generally less than or just as volatile as the broad market.

- 5YR Percent Change: 30% and above. Although I want a dividend stock with stable price movement, I’d also prefer the selected few with potential for capital appreciation.

- Annual Dividend Yield (Forward): I purposely set this as blank so I can sort the results from the highest to the lowest yielding Dividend Aristocrat.

- Current Analyst Rating: 4 to 5 (Moderate to Strong Buy), so I’ll only get Dividend Aristocrats with positive consensus among industry professionals.

- Number of analysts: 8 or more. More professionals covering the stock reflects a more reliable consensus.

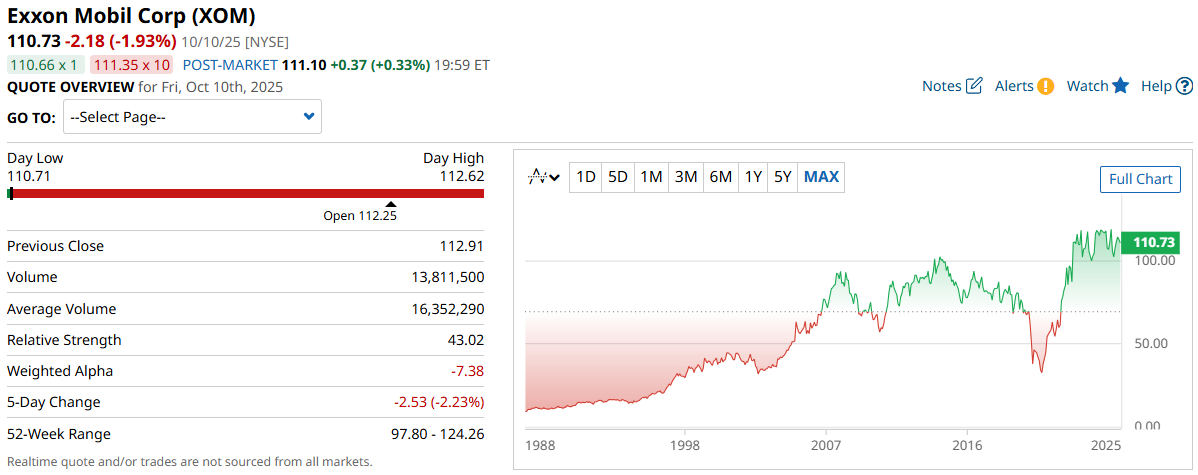

After setting the appropriate filters, I ran the screen and was left with the 8 dividend companies. Then, I sorted out the list from highest to lowest forward dividend yield, and ended up Chevron Corp. (CVX), Exxon Mobil Corp. (XOM), and Coca-Cola Company (KO) as my top 3 highest-yielding, most stable Dividend Aristocrats with a notable potential for capital appreciation.

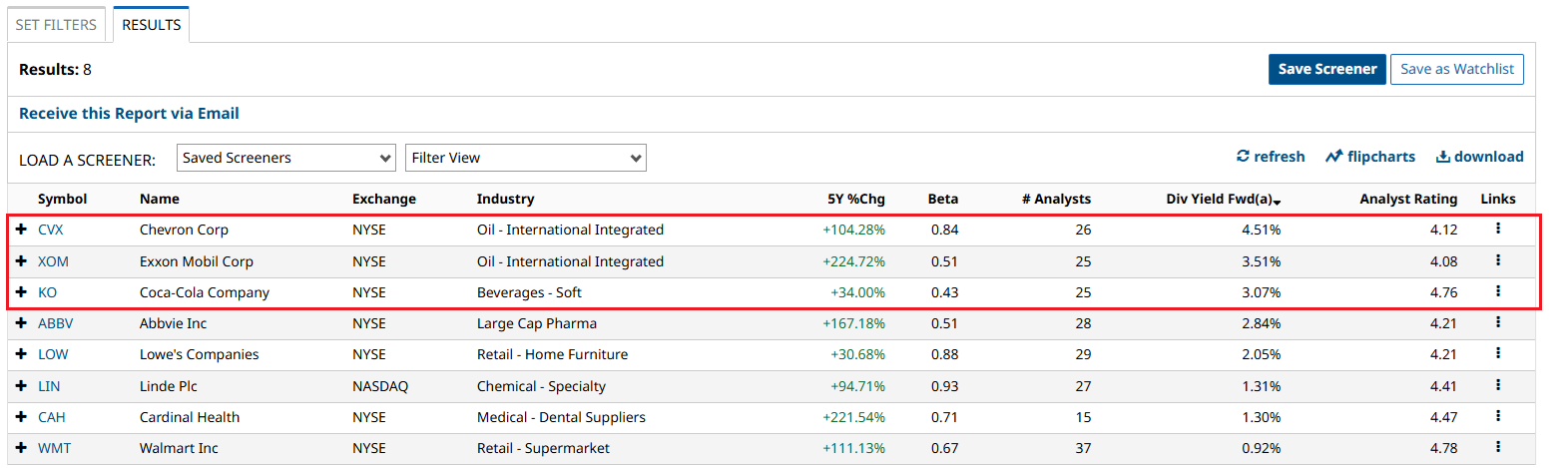

Chevron Corp (CVX)

Chevron Corp. is one of the largest energy companies in the world. They do everything from oil exploration, extraction, and refining, before selling it to enterprise customers or everyday consumers at your nearest Chevron gas station. Recently, the company has also begun investing in cleaner energy options, while maintaining its core oil and gas business.

For 2024, Chevron’s annual revenue rose nearly 1% to $202.78 billion, while its net income dropped 17.35% to $17.66 billion, driven by a notably higher OpEx over the same period. This resulted in a reduced basic EPS of $9.76 (from $11.41). Today, CVX stock trades at $148.90 per share, and has gained nearly 3% on a YTD basis, while 104.28% on a 5-YR scale. The stock’s 60-month beta is 0.84, which indicates stability.

Chevron’s annual forward dividend is $6.84 per share per year, paid $1.71 per quarter. This reflects a forward yield of 4.51%, which is quite respectable in today’s market. The payout ratio is 78.51% of its total earnings, which is still acceptable, but may warrant investors’ attention should it move beyond 80%.

A consensus among 26 analysts rates CVX stock a Moderate Buy with an average score of 4.12 out of 5, and has improved over the past 3 months. The highest price target for the stock is $197 per share, suggesting as much as 32% upside potential from current levels.

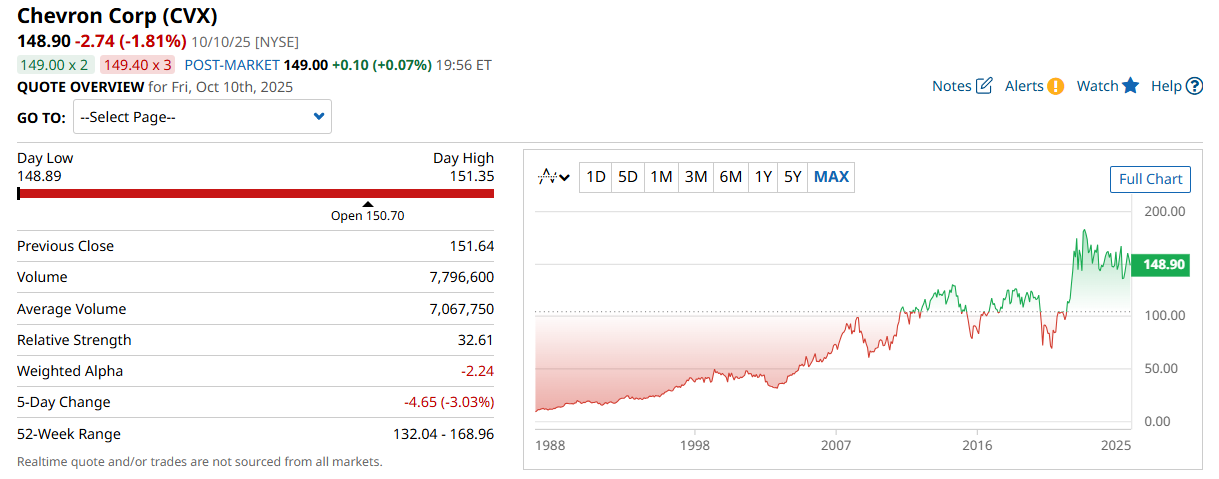

Exxon Mobil Corp (XOM)

The next dividend company is another energy titan, ExxonMobil, an oil and gas company that ranks among the largest publicly traded energy firms currently. Like Chevron, Exxon is also responsible for exploration, extraction, and refining oil and gas into usable products, as well as manufacturing petrochemicals. The company is also working on low-emission innovation and carbon reduction initiatives.

As for Exxon’s financials, the company’s 2024 annual revenue increased nearly 1.5% to $349.58 billion. However, its bottom line figures decreased 6.47% to $33.68 billion, driven by the notably higher cost of goods. Right now, XOM stock trades at $110.73 per share, gaining nearly 3% on a YTD basis while ~225% on a 5YR scale. The 60-month beta is only 0.51, which makes it a very stable dividend stock.

On the dividend front, Exxon pays a forward dividend of $3.96, which is distributed as $0.99 per quarter (per share), reflecting a forward yield of 3.51%. Meanwhile, the dividend payout ratio is 55.24% of its earnings, which is within a very acceptable range for a dividend-paying company.

A total of 25 analysts rate XOM stock a Moderate Buy with an average score of 4.08 out of 5. This rating has been consistent over the past 3 months. The highest price target is $143 per share, which suggests about 30% potential upside for new investors.

Coca-Cola Company (KO)

The last company on my list today is Coca-Cola Company, the largest beverage company in the world. Apart from its iconic Coke, the company also produces over 500 different brands worldwide, including sodas, water, sports drinks, tea, and even coffee.

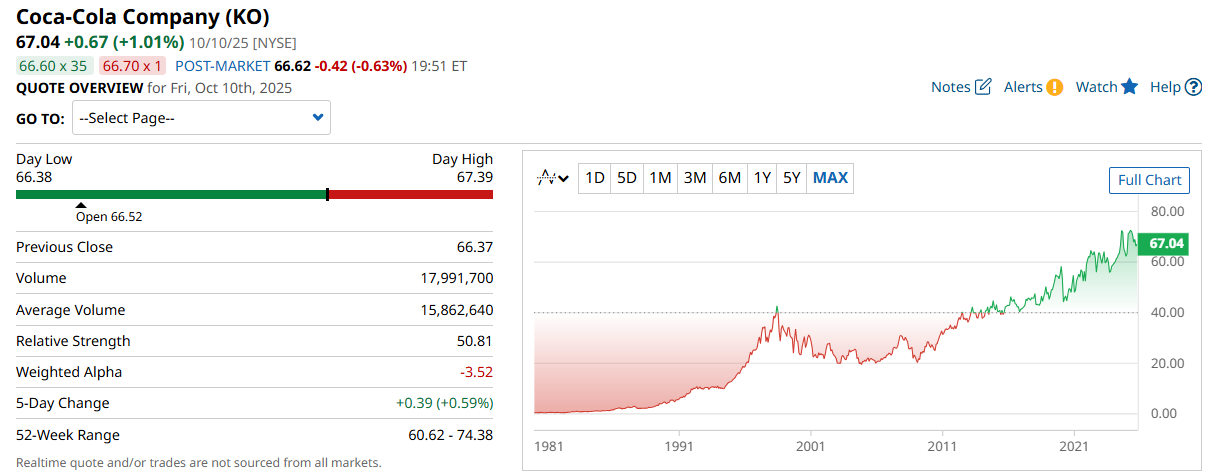

In terms of Coca-Cola’s financials, Coca-Cola’s 2024 revenue rose by 2.8% to $47.06 billion, while its net income remained relatively flat at ~$10.6 billion, or a basic EPS of $2.47. Right now, KO stock trades at $67.04 per share with a 60-month beta of 0.43. Since the beginning of the year, the stock has gained 7.68% and ~34% on a 5-YR scale.

Meanwhile, the company pays a forward dividend of $2.04 per share, which is paid $0.51 per quarter. This payout reflects a forward yield of 3.07%, with a payout ratio of 67.87%.

A consensus among 25 analysts rates KO stock a Strong Buy with an average score of 4.76 out of 5, and this rating has been consistent over the past 3 months. The highest target for the stock is $85 per share, which indicates as much as a 27% upside from the stock’s current levels.

Verdict

These 3 dividend companies are some of the most compelling options for investors who prefer the set-it-and-forget-it approach. They have a solid track record, as well as income and capital appreciation potential. That said, it's imperative to consider any potential investment from various angles, and the filters used to come up with the list of companies are a good starting point for due diligence. After all, the market can turn silly at any time.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.