- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Here's What to Expect From Tractor Supply's Next Earnings Report

/Tractor%20Supply%20Co_%20location%20sign%20by-%20Susan%20Montgomery%20via%20Shutterstock.jpg)

Brentwood, Tennessee-based Tractor Supply Company (TSCO) is a rural lifestyle retailer that caters to recreational farmers, ranchers, and rural homeowners with a diverse product mix that includes livestock and pet supplies, hardware, tools, lawn and garden products, seasonal goods, apparel, and home décor. Valued at a market cap of $28.7 billion, the company is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 23.

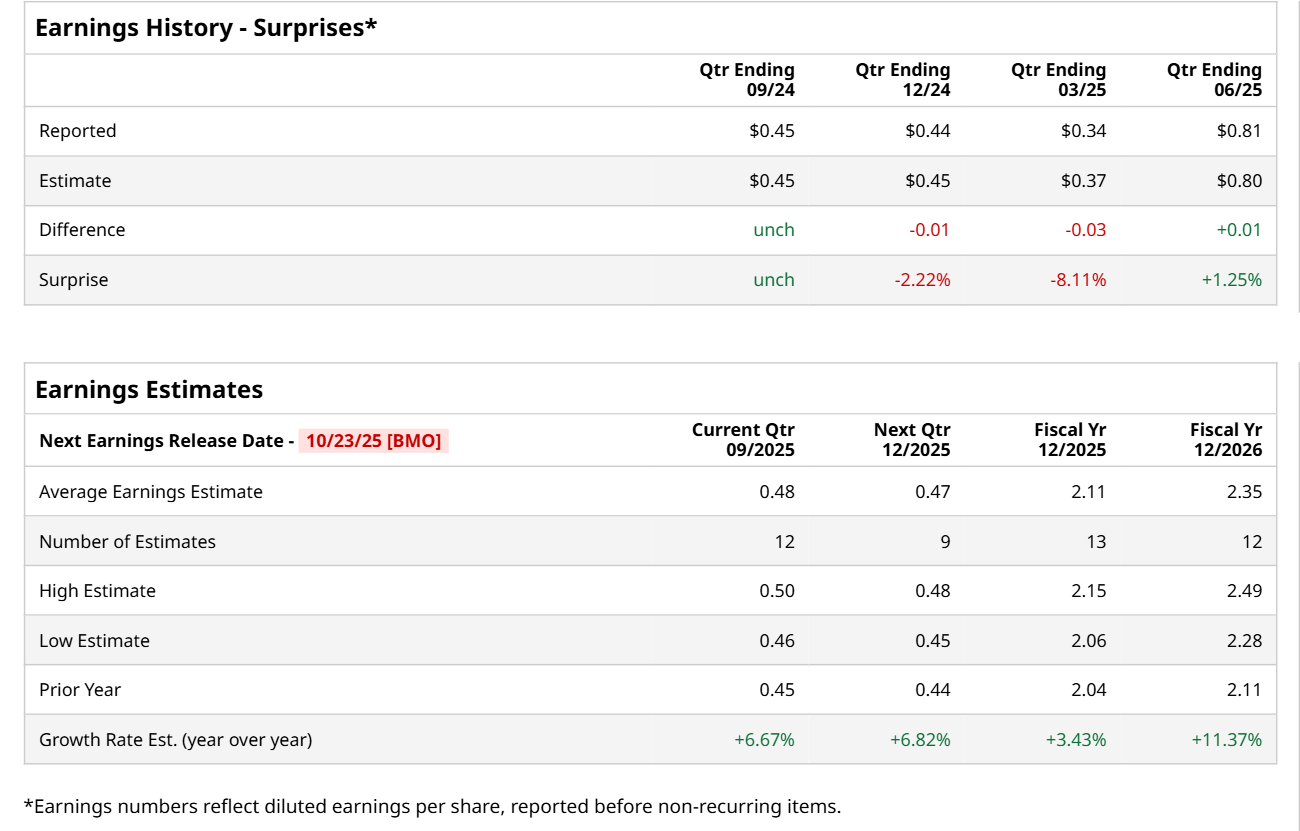

Ahead of this event, analysts expect this rural lifestyle retailer to report a profit of $0.48 per share, up 6.7% from $0.45 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. In Q2, TSCO’s EPS of $0.81 exceeded the forecasted figure by 1.3%

For the current fiscal year, ending in December, analysts expect TSCO to report a profit of $2.11 per share, up 3.4% from $2.04 per share in fiscal 2024. Furthermore, its EPS is expected to grow 11.4% year-over-year to $2.35 in fiscal 2026.

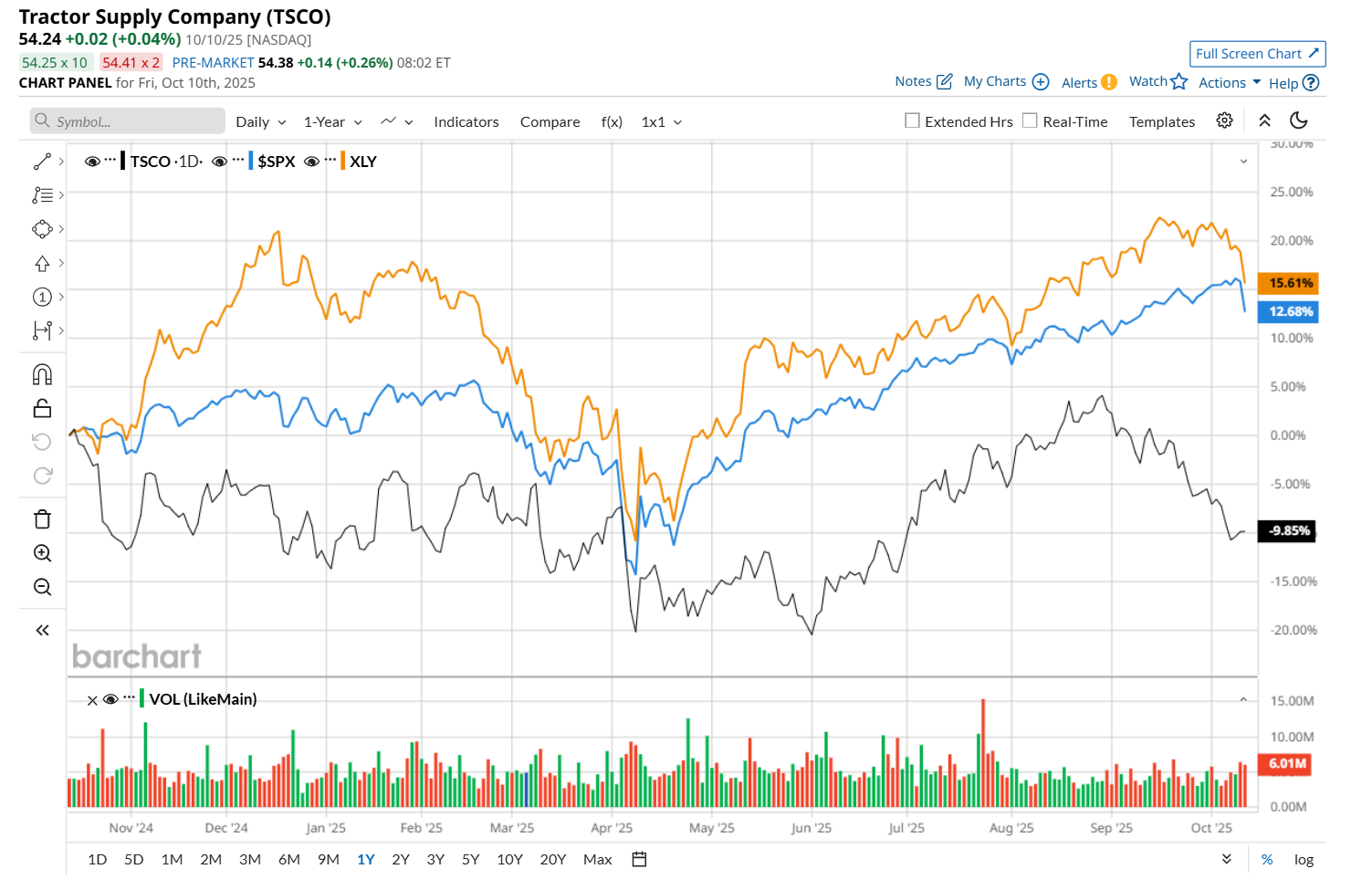

TSCO has declined 10.6% over the past 52 weeks, trailing behind both the S&P 500 Index's ($SPX) 13.4% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 17.4% uptick over the same time frame.

TSCO posted better-than-expected Q2 performance on Jul. 24. Due to contributions from new store openings and the growth in comparable store sales, the company’s total revenue improved 4.5% year-over-year to $4.4 billion, exceeding consensus estimates by a slight margin. Moreover, its EPS came in at $0.81, up 2.5% from the same period last year and 1.3% ahead of analyst estimates. However, its SG&A as a percentage of net sales increased by 50 basis points from the year-ago quarter, primarily due to planned growth investments and modest deleveraging of fixed costs, given the level of comparable store sales. This might have weighed on investor sentiment, leading to a marginal decline in its stock price that day, despite reporting an upbeat performance.

Wall Street analysts are moderately optimistic about TSCO’s stock, with a "Moderate Buy" rating overall. Among 31 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy," 13 suggest "Hold,” and one advises a “Strong Sell.” The mean price target for TSCO is $63.28, implying a 16.7% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.