- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

What to Expect From Public Storage’s Q3 2025 Earnings Report

Based in Glendale, California, Public Storage (PSA) is the leading self-storage real estate investment trust (REIT), running thousands of facilities across the U.S. and internationally. Its extensive real estate presence allows it to deliver secure storage to individuals, families, and businesses nationwide.

Through strategic expansion, ongoing acquisitions, and cutting-edge customer service solutions, Public Storage maintains its industry dominance and continues to grow as an innovator in operational excellence. The company has a market capitalization of $51.66 billion.

Public Storage is set to release its third-quarter results on Oct. 29, after the market closes. Ahead of the results, Wall Street analysts have a subdued view on the company’s bottom-line growth.

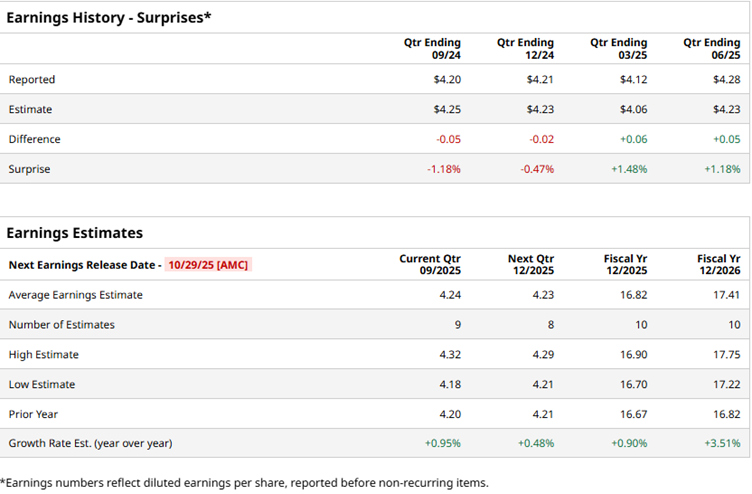

For the third quarter, analysts expect Public Storage’s profit to grow marginally year-over-year (YOY) to $4.24 per diluted share. The company has a mixed record of surpassing Wall Street’s bottom-line estimates, topping them in two of the trailing four quarters and missing them on two other occasions. For the current fiscal year, profit is expected to grow marginally annually to $16.82 per diluted share.

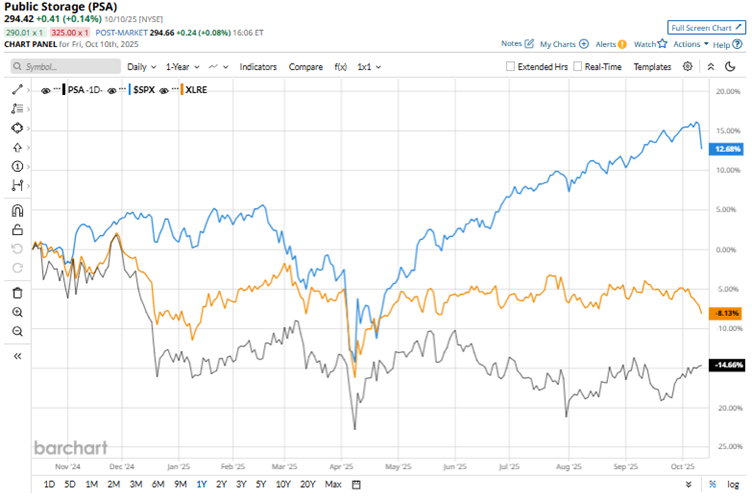

Public Storage’s stock has been underperforming the broader market over the past year. The stock has dropped by 13.9% over the past 52 weeks and 1.7% year-to-date (YTD). On the other hand, the broader S&P 500 Index ($SPX) has gained 13.4% and 11.4% over the same periods, respectively.

Over the past 52 weeks, the real estate sector, as shown by the Real Estate Select Sector SPDR Fund (XLRE), has had a less pronounced decline of 5.4% compared to Public Storage’s stock, while the ETF has gained marginally YTD.

On July 30, Public Storage reported second-quarter results for fiscal 2025. The company’s total revenues increased 2.4% YOY to $1.20 billion, exceeding the $1.19 billion that Wall Street analysts had expected. Its core FFO increased by 1.2% from the prior year’s period to $4.28 per share, which was higher than the $4.23 per share that was expected.

However, rising costs have put some pressure on margins. Its net income per share dropped from $2.66 in Q2 2024 to $1.76 in Q2 2025. Public Storage also provided weak guidance. For the current year, its revenue is expected to grow in the range of -1.3% to 0.8%, while net operating income is projected to grow in the range of -2.6% to 0.3%. Based on this, Public Storage’s stock declined 5.8% intraday on July 31.

Wall Street analysts have been soundly bullish about Public Storage’s prospects. Among the 22 analysts covering the stock, it has a consensus rating of “Moderate Buy” overall. The configuration of the ratings has remained stable, with 13 “Strong Buy” ratings and nine “Hold” ratings.

The mean price target of $323.11 indicates 9.7% upside from current levels, while the Street-high price target of $350 implies an 18.9% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.